Inquire

Saudi Arabia’s Warehousing Market Accelerates Toward 2030 as Vision 2030 Transforms Logistics

TraceData Research has released its latest flagship study — KSA Warehousing Market Outlook to 2030 — offering a comprehensive view of how Saudi Arabia’s warehousing ecosystem is evolving in scale, capability, and strategic relevance.

Built on extensive primary research, regulatory assessments, competitor profiling, and market modelling, the report captures the Kingdom’s transition into one of the world’s most advanced logistics hubs.

This article highlights the core findings, market drivers, and forward-looking themes shaping the sector through 2030.

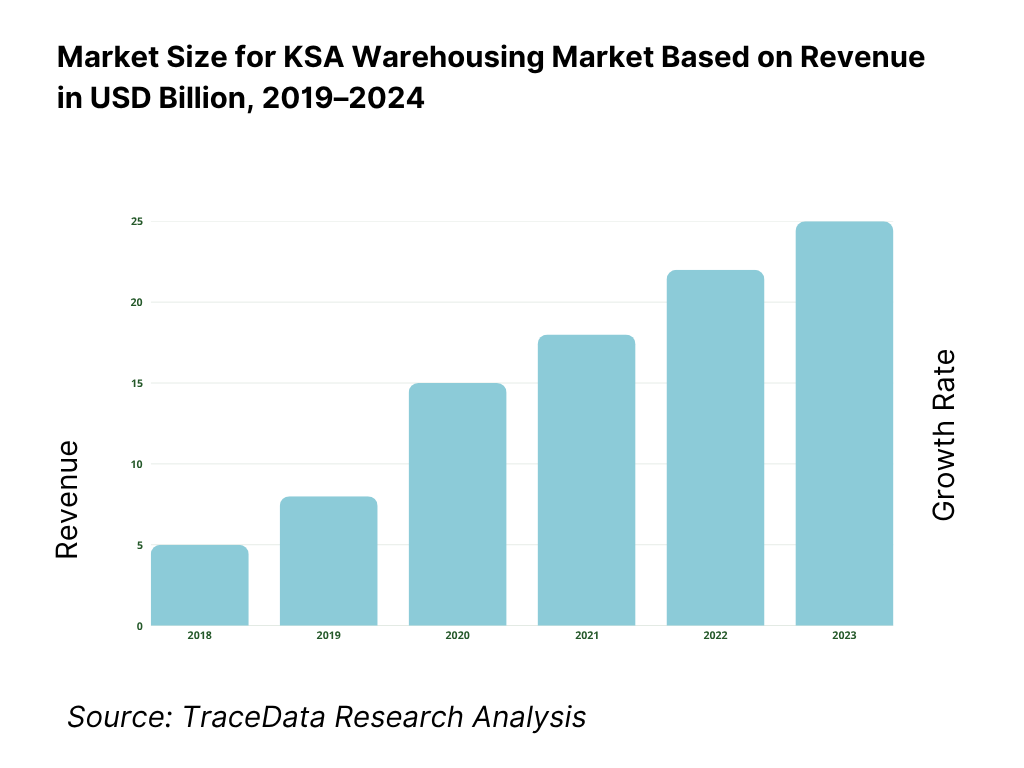

A USD 11.27 Billion Market Entering a High-Momentum Phase

Saudi Arabia’s warehousing market stands at USD 11.27 billion, shaped by the rapid expansion of Grade-A warehouse parks in Riyadh and Jeddah, continued throughput from FMCG and pharma categories, and the deepening of e-commerce fulfilment.

Key indicators reflect a tightening market:

- 8.44 million TEUs processed across ports and ICDs

- Nearly 28 million sqm of logistics stock in Riyadh

- Prime rents around SAR 210 per sqm

- Occupancy levels frequently crossing 97%

Riyadh remains the logistics nucleus, leveraging its scale, MODON estates, and ICD connectivity. Jeddah acts as the western anchor with port-adjacent parks supporting import, export, and cross-dock flows. Dammam, Khobar, and Jubail serve as industrial warehousing centres linked to petrochemicals, while emerging nodes in Yanbu and Medina support Red Sea shipping corridors.

The sector’s growth is increasingly driven by value-added infrastructure and service depth, not just volumetric expansion.

Download the free report today and explore the data for yourself.

Download the free report today and explore the data for yourself.

Growth Drivers: Three Structural Shifts Powering Demand

1. Port Throughput & Trade Expansion

Saudi ports handled 320.8 million tons of cargo and 7.52 million containers, directly boosting demand for:

- Bonded storage

- Cross-docking & transloading

- Multi-temperature capacity

- High-pallet density racking systems

As the economy crosses USD 1.24 trillion, rising imports, exports, and re-exports reinforce the need for large, modern warehousing clusters connected to ports and major consumption centers.

2. Digitized Commerce & High-Frequency Fulfilment

Saudi Arabia processed 12.6 billion electronic retail payment transactions, illustrating the nation’s strong shift toward digital commerce.

This drives warehousing models that support:

- Higher order frequencies

- Reverse logistics

- Multi-client fulfillment

- Value-added services (kitting, labeling, customization)

Retailers are adopting hub-and-spoke distribution models, increasing demand for Grade-A warehouses, bonded e-commerce lanes, and technology-integrated facilities.

3. Air Logistics & Pharma GDP Momentum

Airfreight volumes reached 606,000 tons in six months, supported by:

- 62 million passengers

- 446,000 flights

- A national aviation footprint crossing 111 million annual passengers

This creates strong, consistent demand for airport-area warehouses with:

- GDP-compliant cold chains

- Automated storage

- Emergency power systems

- Express parcel handling capabilities

Pharmaceuticals, electronics, and high-value goods continue to anchor this segment.

Industry Challenges Creating Operational Pressures

Transshipment Volatility

Fluctuations in vessel schedules and transshipment volumes stress bonded capacities and yard planning — especially at Jeddah, Dammam, and Riyadh ICDs. Operators need flexible yard design, overflow management, and hybrid cross-dock solutions.

Technology Gaps vs. Global Benchmarks

Despite cargo strength, customs clearance speed, real-time tracking, and interoperability between WMS/TMS systems remain areas requiring improvement to reach global standards.

Capacity Gaps at Special Logistics Zones

Rising air cargo ambitions and special logistics zone licensing require significant additions in:

- GDP chambers

- Automation

- Apron-side access

- Multi-temperature infrastructure

These gaps represent investment opportunities for developers and 3PLs.

Regulatory Landscape: Frameworks Redefining the Sector

Regulatory Landscape: Frameworks Redefining the Sector

ZATCA Bonded Licensing

Four bonded categories govern operators:

Bonded Zone, Specialized Bonded Zone, Bonded Tanks, Temporary Bonded Zone.

Compliance requirements cover:

- Storage and coding

- Labeling

- Documentation

- Value-added services

These frameworks support the Kingdom’s customs-controlled storage and trade facilitation ambitions.

SFDA GSDP for Pharma Warehousing

Pharmaceutical and medical-device warehouses must comply with:

- GSDP standards

- MDS-REQ12 & MDS-G25 requirements

Ensuring temperature mapping, traceability, and excursion control — critical for Saudi’s rising pharma imports.

GACA Aviation-Linked Permissions

Logistics operators in aviation zones must meet strict infrastructure and operational standards to handle express and high-value cargo efficiently.

Together, these regulations strengthen the ecosystem’s reliability and international competitiveness.

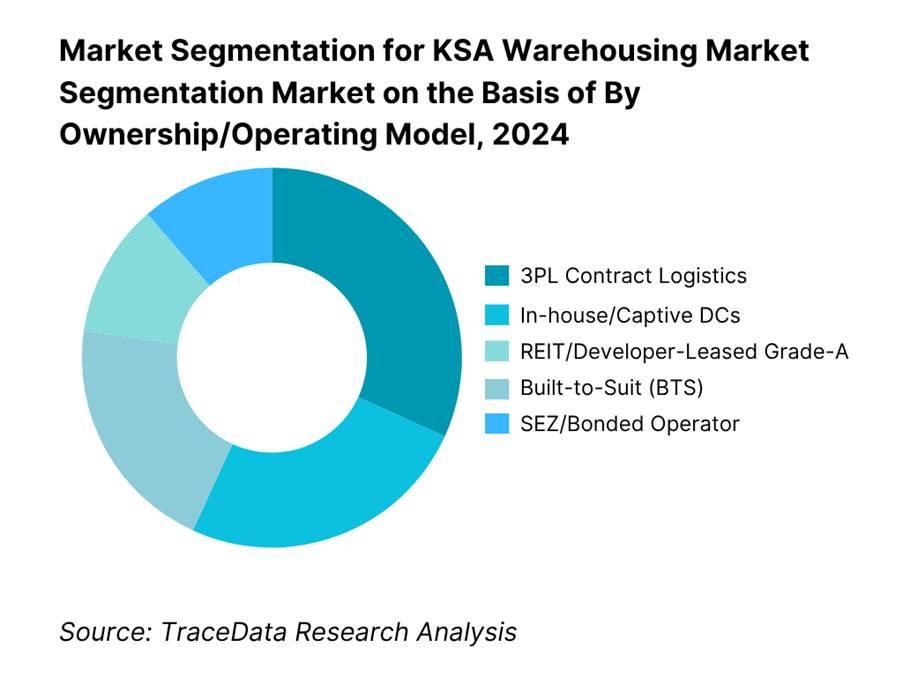

Market Segmentation: A Complex but Clear Structure

By Warehouse Type

Ambient warehouses dominate, driven by FMCG, retail, automotive, and industrial MRO demand. Cold chain and bonded zones are rising from smaller bases.

By Operating Model

3PL contract logistics leads due to flexible pricing, KPI-linked SLAs, and multi-client optimization.

By Function

Storage, fulfillment & distribution, cross-docking, VAS, and reverse logistics define operational categories.

By Temperature Zone

Ambient, chilled, frozen, multi-temperature, and pharma GDP-qualified storage are core segments.

By Region

Riyadh and Jeddah dominate, with growing activity in Dammam/Khobar/Jubail, NEOM–Oxagon, and the southern corridor.

Competition: High Occupancy & Grade-A Scarcity Shape the Landscape

Saudi Arabia’s warehousing competitiveness reflects a mix of global and regional leaders, including Almjagdouie, NAQEL, DHL, Aramex, CEVA, Kuehne+Nagel, DB Schenker, Maersk, LogiPoint, Starlinks, Agility Logistics Parks, and DP World.

Key trends:

- Automation adoption (AS/RS, robotics, real-time visibility)

- Temperature-controlled capacity expansion

- Port- and airport-adjacent Grade-A hubs

- REIT-driven warehouse development

With occupancy near full in major corridors, competition is shifting toward capability differentiation rather than pure footprint expansion.

Get insights tailored to your business — request specific sections or data cuts from the report.

What Lies Ahead: Saudi Warehousing Through 2030

1. Rise of Integrated Logistics Zones

Facilities like Riyadh ISLZ, Jeddah Islamic Port SEZ, and Oxagon will redefine multimodal logistics.

2. Automation & Digital Control Layers

Saudi’s 45+ billion digital transactions ecosystem will enable growth of IoT, robotics, and predictive inventory platforms.

3. Pharma & Temperature-Controlled Expansion

Airfreight growth and healthcare imports will accelerate GDP-compliant storage development.

4. Green Warehousing & Energy Efficiency

Solar rooftops, EV yard fleets, and energy-optimized HVAC will dominate new-build designs.

5. Corridor Diversification

NEOM–Oxagon, SPARK, Jazan EC, and the Land Bridge will redistribute demand across new logistics hubs.

6. Workforce Localization & Upskilling

Saudization and vocational programs will create a skilled talent pipeline for increasingly automated warehouses.

Final Thoughts

KSA warehousing sector is entering a period of structured, technology-led, and corridor-driven growth. The winners will be those who invest early in:

- Automation

- Multi-temperature capacity

- Regulatory compliance

- Integrated network design

The market is maturing — but opportunity is expanding.

TraceData’s KSA Warehousing Market Outlook to 2030 includes:

- Market sizing & revenue forecasts through 2030

- Segmentation across region, temperature zone, warehouse type & model

- Regulatory and policy frameworks (ZATCA, SFDA, GACA)

- Competitor intelligence on 14+ leading operators

- Special focus on integrated logistics zones, pharma GDP, and automation

Contact Us: -

TraceData Research

+91 9266849840

- Managerial Effectiveness!

- Future and Predictions

- Motivatinal / Inspiring

- Other

- Entrepreneurship

- Mentoring & Guidance

- Marketing

- Networking

- HR & Recruiting

- Literature

- Shopping

- Career Management & Advancement

SkillClick

SkillClick