Inquire

Shipbuilding Market Strategies for Maximizing Efficiency and Profitability 2032

Global Shipbuilding Market Outlook 2025-2032: Trends, Drivers, and Competitive Landscape

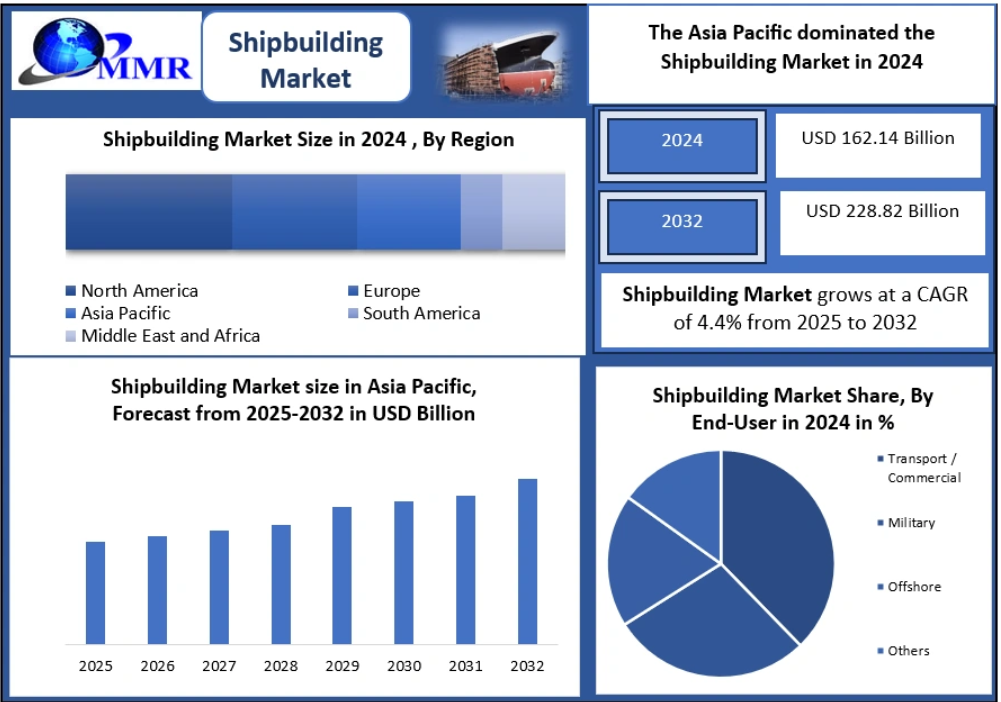

The Global Shipbuilding Market reached a valuation of USD 162.14 billion in 2024 and is projected to grow at a CAGR of 4.4%, reaching USD 228.82 billion by 2032. Shipbuilding remains a cornerstone of global trade and maritime operations, supporting over 90% of world cargo movement while driving economic connectivity across regions.

Overview of the Shipbuilding Industry

Shipbuilding involves the design, construction, and launching of ships and marine vessels using advanced materials, technologies, and specialized shipyards. The market encompasses commercial vessels, naval ships, and offshore support vessels. The Asia Pacific region dominates global shipbuilding, led by China, South Korea, and Japan, which collectively account for more than 93% of production. China alone holds 53% of the global market share, followed by South Korea (28%) and Japan (12%).

Despite the sector’s growth, the industry faces challenges such as market volatility, excess shipyard capacity, rising labor costs, and geopolitical tensions—notably the Russia-Ukraine conflict and Red Sea shipping route disruptions.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/148775/

Key Trends Shaping the Shipbuilding Market

Green Shipbuilding

Environmental regulations by the International Maritime Organization (IMO) are pushing shipbuilders toward energy-efficient and low-emission vessels. This includes LNG-powered ships, hybrid propulsion systems, wind-assisted technologies, and alternative fuels such as ammonia and methanol. Asia Pacific leads this trend, producing a large portion of eco-friendly and dual-fuel vessels, particularly in China, South Korea, and Japan.

Digital Transformation & Industry 4.0

Shipyards are increasingly adopting digital technologies, including AI-driven production planning, digital twins, robotics, and 3D printing, enhancing operational efficiency and reducing construction timelines. Autonomous ships and unmanned surface vessels are creating new opportunities, particularly in naval and offshore segments.

Market Drivers

- Rising Seaborne Trade: With more than 90% of global trade transported by sea, the demand for cargo ships, tankers, LNG carriers, and container vessels continues to grow.

- Government Support: Countries such as China, South Korea, Japan, and India provide subsidies, tax incentives, green financing, and shipyard modernization programs, boosting industry investment. India aims for a 5% global market share by 2032, reflecting its strategic focus on naval modernization and commercial shipbuilding.

Market Restraints

- Skilled Workforce Shortages: Aging workforces and declining vocational enrollment in regions such as Europe, Japan, and South Korea pose significant challenges.

- Rising Labor Costs: Labor expenses have increased 15–25% over the last five years, reducing competitiveness compared to low-cost hubs like China.

- Technology Skill Gap: Digitalization and Industry 4.0 adoption require advanced technical skills, intensifying workforce shortages.

Segment Analysis

By Ship Type

The market is segmented into Tankers, Bulk Carriers, Container Ships, Cargo Ships, Passenger Ships, and Others. Container ships dominate, accounting for 34–36% of new orders in 2024, driven by mega-container vessels (15,000–24,000 TEU), e-commerce expansion, and global logistics investments. Notably, over 45% of alternative-fuel vessel orders were container ships, emphasizing the shift toward greener maritime operations.

By Material Type

Steel dominates the shipbuilding material market, representing over 85% of materials used in 2024–2025 due to its strength, durability, and cost-effectiveness. Advanced grades, such as high-tensile steel (HTS) and EH36 marine steel, are increasingly used in LNG-fueled and large-capacity vessels for safety and fuel efficiency.

By Process & Propulsion Technology

The shipbuilding process includes designing, planning, cutting & welding, assembly, outfitting, launching, and testing. In terms of propulsion, conventional, dual-fuel LNG, hybrid/electric, and other innovative technologies are shaping modern ship design.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/148775/

Regional Insights

- Asia Pacific: Dominates the market, led by China, South Korea, and Japan, which together account for 93% of global output. China built 36 million gross tons in 2023, exporting 75% of its production.

- Europe: Specializes in cruise and high-value vessels, with leaders like Fincantieri in Italy.

- North America: Focuses on smart naval systems and offshore vessels.

- Emerging Markets: India, the Philippines, and Vietnam are growing players, leveraging government incentives, competitive labor costs, and infrastructure improvements.

Competitive Landscape

The shipbuilding market is highly consolidated, dominated by Asian giants:

- China: CSSC, CSIC, Jiangnan Shipyard, Hudong-Zhonghua

- South Korea: HD Hyundai Heavy Industries, Samsung Heavy Industries, Hanwha Ocean

- Japan: Mitsubishi Heavy Industries, Imabari, Japan Marine United

- Europe: Fincantieri, Damen Shipyards, Meyer Werft, Lürssen

Recent innovations include Hyundai Heavy Industries’ HCX-23 trimaran naval concept and the CSSC-CSIC merger, creating the world’s largest shipbuilding conglomerate with combined assets of USD 56 billion and an annual revenue of USD 16 billion.

Future Outlook

The global shipbuilding market will continue to grow, driven by rising seaborne trade, green shipbuilding, and digital transformation. Asia Pacific will maintain its leadership, while emerging markets and government initiatives are expected to diversify global production. Innovations in autonomous ships, LNG carriers, hybrid propulsion, and digital shipyards will shape the future of maritime manufacturing, offering opportunities for sustainable and technologically advanced vessel production.

- Managerial Effectiveness!

- Future and Predictions

- Motivatinal / Inspiring

- Other

- Entrepreneurship

- Mentoring & Guidance

- Marketing

- Networking

- HR & Recruiting

- Literature

- Shopping

- Career Management & Advancement

SkillClick

SkillClick