Inquire

Car Leasing Market Trends Highlight Rising Demand Among Urban Millennials 2032

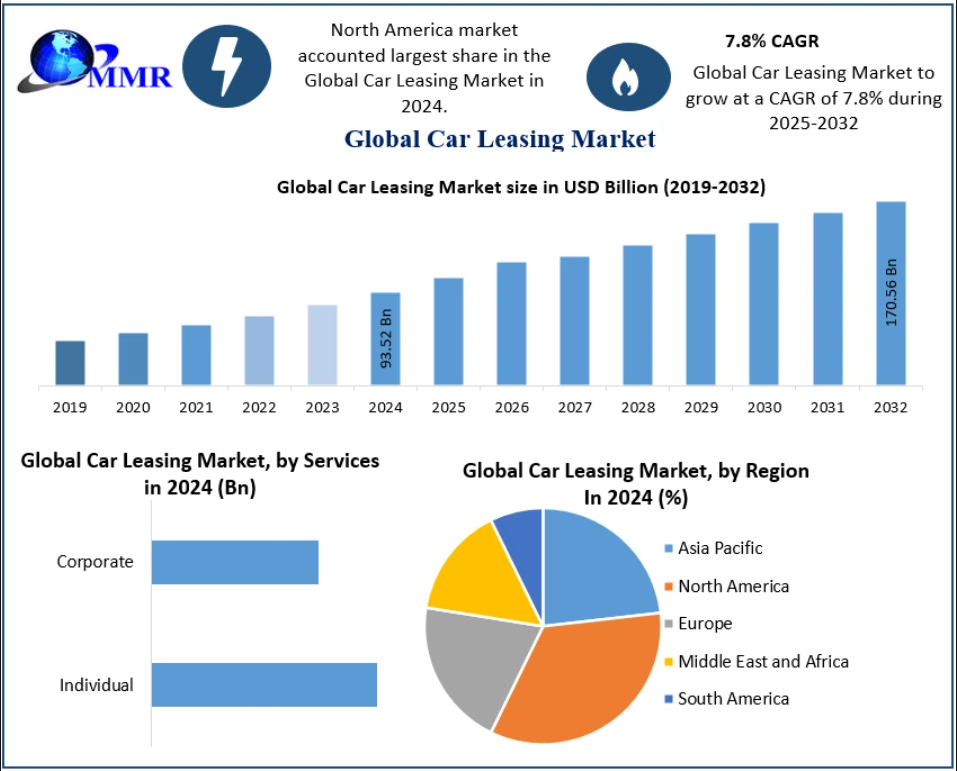

Car Leasing Market Accelerates Toward USD 170.56 Billion by 2032 as Urban Mobility and Subscription Models Gain Momentum

The Car Leasing Market, valued at USD 93.52 billion in 2024, is on a strong growth trajectory. The market is projected to expand at a CAGR of 7.8% between 2025 and 2032, ultimately reaching USD 170.56 billion. With corporate mobility evolving, changing consumer ownership preferences, and rapid urbanization, the car leasing landscape is undergoing a transformative shift that is redefining both business and personal transportation.

Market Overview

The global mobility ecosystem is transitioning from conventional car ownership to flexible usage-based models. Nearly 66% of new vehicles are registered under corporate ownership, reflecting the dominance of true fleet operations. As business models evolve, this share is expected to rise from 53% today to nearly 63% in the coming years.

Corporate accounting reforms, sustainability norms, digital subscription platforms, and a rising preference for low-cost mobility have accelerated the adoption of vehicle leasing. Major automotive giants such as BMW, Porsche, and General Motors are actively exploring subscription-based revenue streams, further legitimizing leasing as the future of user-centric mobility.

Meanwhile, consumers are increasingly recognizing that 60% of total vehicle ownership cost is incurred during usage, making leasing a cost-efficient alternative.

To know the most attractive segments, click here for a free sample of the report: https://www.maximizemarketresearch.com/request-sample/67834/

Market Dynamics

1. Rising Urbanization and Smart City Development

Global urbanization is rapidly intensifying, fueling demand for optimized mobility solutions. As cities move toward smart infrastructure, leasing emerges as a critical enabler by offering flexible access to vehicles without long-term ownership burdens. With urban populations rising sharply, the need to reduce traffic congestion and increase mobility efficiency directly contributes to leasing growth.

2. Shift from Ownership to Subscription-Based Mobility

Consumers are increasingly opting for subscription-based mobility for its affordability, flexibility, and minimal long-term commitment. This shift is reshaping the automotive value chain, with subscription models enhancing customer experience while ensuring predictable operating costs for users.

3. Government Initiatives Toward Green Mobility

Global regulatory bodies are pushing aggressive carbon reduction targets.

- France is offering tax exemptions on leased vehicles to support tourism and reduce emissions.

- Europe aims to reduce carbon emissions by 80% by 2050, tightening CO₂ standards to 95 g/km currently and further to 84 g/km by 2032.

Leasing models make it easier for consumers to upgrade to eco-friendly vehicles, especially electric cars with high upfront costs. In the U.S., nearly 80% of electric vehicle sales are linked to leasing, highlighting its role in accelerating EV penetration.

4. Total Cost of Ownership (TCO) Advantage

With nearly 40% of a vehicle’s cost tied to purchase and the rest associated with ownership, consumers and corporates find leasing to be a far more economical mobility choice. Predictable monthly payments, maintenance-inclusive packages, and vehicle return options further enhance cost efficiency.

Market Segmentation Analysis

By Application Type

Business Use dominates the market and will continue holding the largest share through 2032.

Leasing for managerial and executive employees has become standard among global corporations. Companies provide employees with upgraded leased vehicles every 3 to 5 years, significantly reducing personal financial burden and enhancing workforce satisfaction.

By Lease Type

Open-End Leasing is expected to grow the fastest and remains ideal for businesses with high-mileage or heavy-duty fleet requirements.

Key benefits include:

- No damage penalty parameters

- High flexibility in usage

- Suitability for fleets operating in demanding environments

These qualities make open-end leasing ideal for specialty vehicles, utility vans, and trucks.

By Vehicle Type

- Non-Commercial Vehicles dominate given their use for corporate mobility and personal transportation.

- Commercial Vehicles are gaining traction with expanding logistics, ride-sharing, and last-mile delivery operations.

By Mode

- Online Leasing Platforms are growing rapidly due to digital onboarding, transparent pricing, and contactless vehicle selection.

- Offline Channels remain relevant but are experiencing steady digital disruption.

By Services

- Corporate Leasing leads due to enterprise fleet expansion.

- Individual Leasing is rising on the back of subscription services and flexible financial plans.

To know the most attractive segments, click here for a free sample of the report: https://www.maximizemarketresearch.com/request-sample/67834/

Regional Insights

North America

North America remains a dominant force due to:

- High leasing awareness

- Attractive interest rates

- Growing EV leasing incentives

Consumers prefer leasing due to the convenience of upgrades and inclusive service packages.

Europe

Europe is another leading region with advanced fleet management policies.

- Vehicle registrations are expected to reach 2.9 million in the coming years.

- Strong environmental regulations and attractive leasing schemes support continuous market expansion.

Auto Europe continues to lead globally, catering to customers across the U.S. and international markets.

Asia Pacific

Asia Pacific is the fastest-growing region, driven by:

- High passenger car production

- Rising per capita income

- Rapid urbanization and digital adoption

Nearly 75% of future global growth in car rental and leasing will be driven by APAC. India, China, and Japan are poised to dominate regional market share.

Middle East, Africa & South America

These regions are gradually embracing vehicle leasing due to:

- Digitalization

- Corporate expansion

- Favorable government mobility policies

Brazil leads growth in South America, while GCC countries and South Africa show strong potential.

Competitive Landscape

Leading players are focusing on expanding their fleet services, integrating digital leasing platforms, and offering EV-friendly subscription models. Key companies include:

- Athlon Car Lease International BV

- Avis Budget Group Inc.

- Enterprise Holdings Inc.

- ALD SA

- LeasePlan Corporation NV

- Hertz Global Holdings

- Sixt SE

- Arval Service Lease

- Emkay

- United Leasing & Finance

- Element Management Corp., among others

These companies are concentrating on long-term contracts, fleet electrification, and mobility-as-a-service (MaaS) innovations to strengthen market presence.

Conclusion

The global Car Leasing Market is entering a high-growth phase driven by the convergence of urbanization, sustainability mandates, digital mobility solutions, and changing consumer preferences. As corporates and individuals seek more flexible, cost-efficient, and eco-friendly mobility options, vehicle leasing stands at the forefront of the future transportation landscape.

With digital platforms redefining subscription experiences and electric vehicle adoption rising, leasing is poised to become one of the most significant pillars of global mobility by 2032.

- Managerial Effectiveness!

- Future and Predictions

- Motivatinal / Inspiring

- Other

- Entrepreneurship

- Mentoring & Guidance

- Marketing

- Networking

- HR & Recruiting

- Literature

- Shopping

- Career Management & Advancement

SkillClick

SkillClick