Inquire

HOW DOES FOREX COMPARE TO OTHER MARKETS ??

Posted 2025-06-05 06:22:27

0

224

The foreign exchange market (forex, FX, or currency market) is a global decentralized or over-the-counter (OTC) market for the trading of currencies. This market determines foreign exchange rates for every currency. It includes all aspects of buying, selling and exchanging currencies at current or determined prices.

-

Currency Pairs:Forex trading involves trading currency pairs, where the value of one currency is expressed in relation to another, such as EUR/USD (Euro against US Dollar).

Exchange Rates:

The price of one currency relative to another is called the exchange rate. These rates fluctuate based on various factors, including supply and demand, economic indicators, and central bank policies.

Leverage:

Forex trading often involves leverage, allowing traders to control larger positions with a smaller amount of capital. This can amplify both profits and losses.

Trading Volume:

Forex is a high-volume market, with billions of dollars traded daily.

Over-the-Counter (OTC):

Forex trading is decentralized, meaning it doesn't take place on a single exchange but rather through a network of banks and brokers.

Liquidity:

The forex market is highly liquid, meaning it's easy to buy and sell currencies, making it a popular market for investors.

Risk:

Forex trading involves risk due to market volatility and leverage, but also offers the potential for high returns.

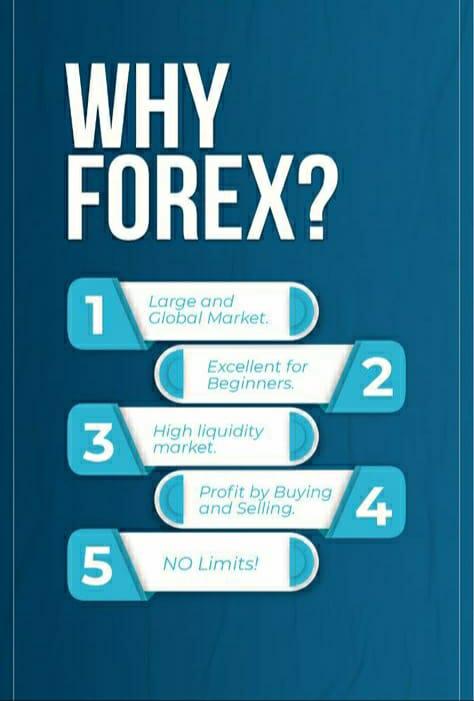

here the key differences of forex to other markets:

-

Decentralization:Forex is a decentralized market, meaning there's no single exchange where trades take place. Instead, transactions occur over-the-counter between banks and brokers.

-

Trading Hours:Forex is open 24 hours a day, five days a week, unlike stock markets which operate during specific hours.

-

Liquidity:Forex boasts the highest liquidity of any market, making it easy to enter and exit trades with minimal price impact.

-

Leverage:Forex brokers often offer substantial leverage, allowing traders to control large positions with relatively small amounts of capital.

-

Assets:Forex involves trading currency pairs, while stock markets involve buying and selling company shares.

-

Regulation:Forex trading is less heavily regulated than traditional stock markets, with fewer rules and no clearinghouses.CONCLUSION:In conclusion, the foreign exchange market is a dynamic and essential component of the global financial system. It serves as a platform for the exchange of currencies between countries, facilitating international trade and investment.

Search

Categories

- Managerial Effectiveness!

- Future and Predictions

- Motivatinal / Inspiring

- Other

- Entrepreneurship

- Mentoring & Guidance

- Marketing

- Networking

- HR & Recruiting

- Literature

- Shopping

- Career Management & Advancement

Read More

palm horizon

Ultimate Guide to Machinery Spare Parts HS Codes in Saudi Arabia

Importing machinery spare parts...

What Makes Hasen Shower Channel Drain China Durable

Selecting the ideal Shower Channel Drain China from hasen-home is essential for creating a...

Animal Feed Market: Insights into Asia-Pacific Growth Potential

The progressive Animal Feed Market owes much of its growth momentum to advancements...

PRP Hair Treatment: A Natural Method for Hair Strengthening

Hair loss and thinning are concerns that affect millions of people worldwide, impacting...

Restaurant Commercial Kitchen Equipment in Noida: Building Efficient and Hygienic Restaurant Kitchens

The restaurant industry in Noida is growing at a rapid pace. From standalone restaurants and...

SkillClick

SkillClick