Inquire

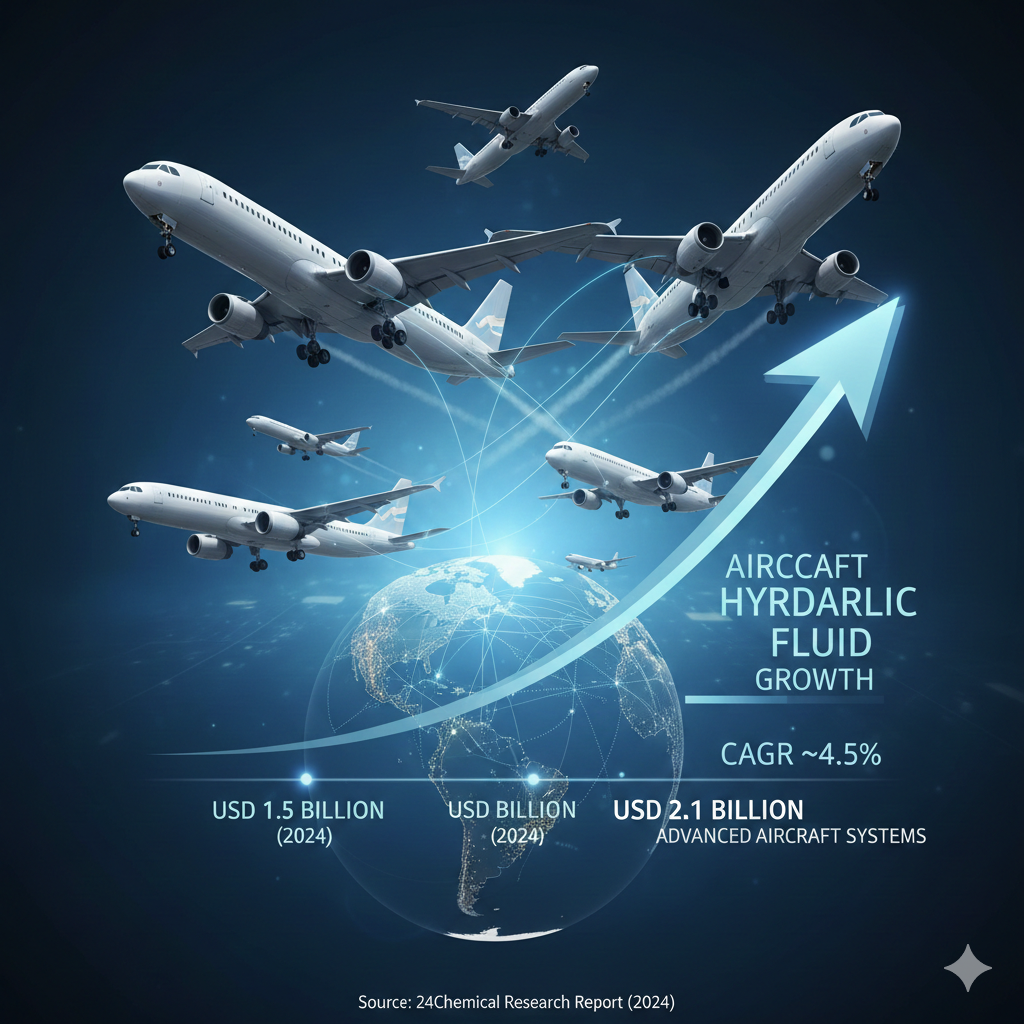

Aircraft Hydraulic Fluid Market Growth Driven by Fleet Expansion and Advanced Aircraft Systems

According to a new report from 24Chemical Research, Aircraft Hydraulic Fluid market was valued at approximately USD 1.5 billion in 2024 and is projected to reach USD 2.1 billion by 2030, exhibiting a steady Compound Annual Growth Rate (CAGR) of around 4.5% during the forecast period. The market is being shaped by a confluence of factors including a robust rebound in global air travel post-pandemic and the introduction of next-generation aircraft fleets with advanced hydraulic systems.

Aircraft hydraulic fluid, the lifeblood of an aircraft's critical flight control systems, landing gear, and brakes, is a sophisticated, specially formulated fluid designed to operate under extreme pressures and temperature variations, from the frigid conditions at high altitude to the intense heat generated by system operation. Its primary function is to transmit power efficiently and reliably, acting as an incompressible medium within a closed-loop system. These fluids must possess exceptional thermal stability, lubrication properties, and resistance to fire, making their formulation and quality paramount to flight safety. While mineral-based oils have a long history, the market is witnessing a definitive shift towards advanced synthetic and phosphate ester-based fluids, which offer superior performance and enhanced safety margins.

Get Full Report Here: https://www.24chemicalresearch.com/reports/248465/global-aircraft-hydraulic-fluid-forecast-market-2…

Market Dynamics:

The trajectory of the Aircraft Hydraulic Fluid market is governed by a complex interplay of powerful growth drivers, persistent operational restraints, and increasingly stringent regulatory pressures that collectively influence adoption and innovation.

Powerful Market Drivers Propelling Expansion

Global Fleet Expansion and Modernization: The single most significant driver is the ongoing global fleet expansion. Major aircraft manufacturers like Boeing and Airbus have backlogs exceeding 13,000 aircraft collectively, signaling strong demand for new, fuel-efficient planes for decades to come. Each new aircraft delivery directly translates into a long-term demand stream for hydraulic fluids. Furthermore, the modernization of aging fleets, particularly in emerging economies, is replacing older aircraft that may have used different, often less efficient, fluid specifications, thereby driving upgrades to modern, high-performance fluids.

Stringent Safety and Regulatory Mandates: Aviation is one of the most heavily regulated industries globally. Regulatory bodies like the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA) mandate the use of approved fluids that meet rigorous performance standards, such as MIL-PRF-5606 for mineral-based fluids and MIL-PRF-83282/87257 for synthetic types. The relentless focus on enhancing aviation safety compels operators to use only the highest-quality, certified fluids, creating a stable, non-discretionary demand base. Recent updates to these specifications emphasize improved fire resistance and environmental compatibility.

Rising MRO Activities and Fleet Utilization: As the global fleet grows and ages, Maintenance, Repair, and Overhaul (MRO) activities are increasing correspondingly. The global MRO market is projected to surpass $120 billion annually by 2030. Hydraulic system servicing, including fluid replacement, flushing, and leak repairs, is a routine but critical part of both scheduled and unscheduled maintenance. Higher fleet utilization rates, driven by recovering passenger traffic, lead to more frequent maintenance cycles, thereby consistently driving aftermarket fluid demand.

Download FREE Sample Report: https://www.24chemicalresearch.com/download-sample/248465/global-aircraft-hydraulic-fluid-forecast-…

Significant Market Restraints Challenging Operations

Despite its essential nature, the market navigates several persistent operational and economic challenges.

High Cost and Complexity of Synthetic Fluids: While synthetic phosphate ester-based fluids offer superior fire resistance—a critical safety feature—their production is significantly more complex and costly than that of mineral oils. The sophisticated chemical synthesis and stringent purification processes can make these fluids 3 to 5 times more expensive than their mineral-based counterparts. For cost-sensitive operators, especially in regional and cargo operations, this price differential can be a considerable factor in operational budgeting, sometimes delaying upgrades to safer but more expensive fluid types.

Environmental and Handling Concerns: Hydraulic fluids, particularly older types, pose environmental and health challenges. They are classified as hazardous materials, requiring special procedures for handling, storage, and disposal. Spills can lead to significant environmental remediation costs and regulatory penalties. Furthermore, the industry is under growing pressure to develop more biodegradable and less toxic formulations, which involves substantial R&D investment. The disposal of used fluid, which is often contaminated with metals and other particulates, adds another layer of cost and logistical complexity for operators.

Critical Market Challenges Requiring Diligence

Beyond cost and environmental issues, the market faces technical and supply chain challenges that demand constant attention.

A primary challenge is ensuring fluid compatibility and purity. Contamination is the enemy of hydraulic systems. Even minute amounts of water, air, or particulate matter can lead to valve sticking, pump failures, and corrosion, potentially resulting in critical system malfunctions. Maintaining the ultra-high purity required (<1-2% water content, specific particulate counts) demands sophisticated filtration systems and rigorous maintenance protocols. A single contamination event can lead to costly component replacements and aircraft downtime, often running into hundreds of thousands of dollars.

Additionally, the market is navigating a transition in material compatibility. As aircraft manufacturers incorporate more composite materials and new elastomers into airframes and systems, the compatibility of existing hydraulic fluids must be revalidated. Some newer materials may be susceptible to degradation when exposed to certain fluid chemistries over long periods. This necessitates close collaboration between fluid manufacturers, airframe builders, and material scientists to ensure long-term system integrity, adding time and cost to new aircraft development programs.

Vast Market Opportunities on the Horizon

Development of "Eco-Friendly" and Extended-Life Fluids: There is a significant and growing opportunity in the development of next-generation fluids with improved environmental profiles. Research is focused on creating fluids with higher biodegradability and lower toxicity without compromising fire-resistant properties. Furthermore, fluids that offer extended service intervals—through enhanced thermal and oxidative stability—present a major value proposition. Reducing the frequency of fluid changes directly lowers maintenance labor costs, fluid consumption, and waste disposal volumes, offering substantial operational savings for airlines.

Integration with Health and Usage Monitoring Systems (HUMS): The rise of data analytics and predictive maintenance opens new frontiers. The integration of fluid condition monitoring sensors into aircraft HUMS can provide real-time data on fluid quality, moisture content, and particulate levels. This shift from scheduled, preventative maintenance to condition-based maintenance can optimize fluid change intervals, prevent unexpected failures, and maximize component lifespan. Fluid manufacturers who can develop smart fluids or compatible sensor technologies are poised to capture significant value in this evolving ecosystem.

Growth in Unmanned Aerial Vehicles (UAVs) and Military Aviation: Beyond commercial aviation, the expanding markets for large UAVs and military aircraft represent robust growth avenues. Military aircraft, which often operate in more extreme conditions, demand fluids with the highest performance specifications. Similarly, the development of large cargo and surveillance drones, which utilize hydraulic systems for payload operation and flight controls, creates a new and growing segment for specialized hydraulic fluids.

In-Depth Segment Analysis: Where is the Growth Concentrated?

By Type:

The market is segmented into Mineral Oil, Synthetic Oil, and Bio-based Oil. Synthetic Oil, particularly phosphate esters, dominates the commercial aviation sector due to its superior fire-resistant properties, which are mandated for most large commercial jet aircraft. These fluids can withstand extreme temperatures and are self-extinguishing, a critical safety feature. Mineral Oil still finds application in older aircraft models and some general aviation platforms where the fire resistance of synthetic fluids is not a regulatory requirement, prized for its good lubricity and lower cost. Bio-based Oil is an emerging segment, driven by environmental sustainability goals, though it currently holds a niche position as the industry balances performance with eco-friendly attributes.

By Application:

Application segments include Propeller Aircraft, Jet Aircraft, Rotorcraft, and others. The Jet Aircraft segment is the undisputed leader in terms of market share and volume consumption. This dominance is a direct result of the massive global fleet of commercial jets, each requiring significant quantities of high-performance hydraulic fluid for flight controls, thrust reversers, and landing gear. The Rotorcraft segment (helicopters) also represents a significant market, as helicopters rely heavily on hydraulic systems for stability and control, often operating in demanding environments that test fluid performance.

By End-User Industry:

The end-user landscape is primarily divided between Commercial Aviation, Military Aviation, and General Aviation. Commercial Aviation is the largest consumer, driven by high fleet numbers and intensive usage patterns. The sector's strict adherence to safety regulations ensures a consistent demand for premium, certified synthetic fluids. The Military Aviation sector is a key driver of innovation, demanding fluids that meet extreme performance criteria for fighter jets, transport planes, and helicopters. General Aviation, while a smaller market in volume, represents a diverse range of aircraft with varying fluid requirements.

Download FREE Sample Report: https://www.24chemicalresearch.com/download-sample/248465/global-aircraft-hydraulic-fluid-forecast-…

Competitive Landscape:

The global Aircraft Hydraulic Fluid market is a consolidated arena dominated by a handful of multinational energy and chemical giants, alongside specialized lubricant manufacturers. The market is characterized by high barriers to entry due to stringent certification requirements, extensive R&D costs, and the necessity of establishing long-term trust with aircraft manufacturers and airlines. The top players—Shell plc, ExxonMobil Corporation, and BP plc (Castrol)—collectively command a significant portion of the global market share. Their dominance is anchored in decades of experience, vast technical service networks, and products that carry crucial OEM (Original Equipment Manufacturer) approvals from Boeing, Airbus, and others.

List of Key Aircraft Hydraulic Fluid Companies Profiled:

Shell plc (Netherlands/UK)

ExxonMobil Corporation (U.S.)

BP plc (Castrol) (UK)

Chevron Corporation (U.S.)

Phillips 66 Company (U.S.)

PetroChina Company Limited (China)

PJSC Lukoil (Russia)

Idemitsu Kosan Co., Ltd. (Japan)

China Petroleum & Chemical Corporation (Sinopec) (China)

Indian Oil Corporation Ltd. (India)

Bel-Ray Company, LLC (U.S.)

Morris Lubricants (UK)

Penrite Oil (Australia)

Bechem Lubrication Technology (Germany)

Valvoline Inc. (U.S.)

Peak Lubricants (Australia)

The competitive strategy in this market heavily emphasizes long-term technical partnerships with airframe and system OEMs to secure approvals for new aircraft programs. Beyond product supply, leading companies differentiate themselves through extensive technical support and MRO services, helping airlines optimize their fluid management practices, troubleshoot issues, and ensure compliance. Continuous R&D to improve fluid performance and environmental characteristics is a cornerstone of maintaining a competitive edge.

Regional Analysis: A Global Footprint with Distinct Leaders

North America: This region holds the largest market share, driven primarily by the massive aviation market in the United States, which is home to the world's largest commercial airline fleet and a formidable military aviation sector. The presence of major aircraft manufacturers (Boeing) and leading fluid producers (ExxonMobil, Chevron) further solidifies its leadership. The region's mature MRO industry and strict regulatory environment ensure consistent, high-value demand for advanced synthetic hydraulic fluids.

Europe & Asia-Pacific: Europe is a powerhouse, anchored by Airbus and supported by a dense network of major airlines and MRO providers. Stringent EASA regulations mirror those in North America, driving the adoption of high-performance fluids. The Asia-Pacific region is the fastest-growing market, fueled by rapid economic expansion, burgeoning middle-class populations, and massive fleet expansions by airlines in China, India, and Southeast Asia. Government investments in airport infrastructure and national carriers are key growth accelerators in this region.

Middle East & Africa, and South America: These regions represent emerging markets with significant potential. The Middle East, home to major long-haul carriers like Emirates and Qatar Airways, has a high concentration of wide-body aircraft that consume substantial volumes of hydraulic fluid. Growth here is tied to regional economic diversification and tourism. South America and Africa present longer-term growth opportunities as their aviation infrastructure continues to develop and intra-regional travel increases.

Get Full Report Here: https://www.24chemicalresearch.com/reports/248465/global-aircraft-hydraulic-fluid-forecast-market-2…

Download FREE Sample Report: https://www.24chemicalresearch.com/download-sample/248465/global-aircraft-hydraulic-fluid-forecast-…https://www.24chemicalresearch.com/download-sample/248465/global-aircraft-hydraulic-fluid-forecast-…

About 24chemicalresearch

Founded in 2015, 24chemicalresearch has rapidly established itself as a leader in chemical market intelligence, serving clients including over 30 Fortune 500 companies. We provide data-driven insights through rigorous research methodologies, addressing key industry factors such as government policy, emerging technologies, and competitive landscapes.

Plant-level capacity tracking

Real-time price monitoring

Techno-economic feasibility studies

International: +1(332) 2424 294 | Asia: +91 9169162030

Website: https://www.24chemicalresearch.com/

- Managerial Effectiveness!

- Future and Predictions

- Motivatinal / Inspiring

- Other

- Entrepreneurship

- Mentoring & Guidance

- Marketing

- Networking

- HR & Recruiting

- Literature

- Shopping

- Career Management & Advancement

SkillClick

SkillClick