Inquire

Online Identity Verification and Face Match Verification: Building Trust in the Digital World

In today’s fast-paced digital economy, businesses are increasingly operating online, making secure and reliable customer onboarding more important than ever. Online identity verification and face match verification have emerged as essential technologies that help organizations prevent fraud, comply with regulations, and build trust with users in a fully digital environment.

Online identity verification is the process of confirming a user’s identity remotely using digital tools. Instead of requiring physical documents or in-person verification, businesses can validate identity through scanned ID documents, selfies, and automated verification systems. This approach is widely used across banking, fintech, telecom, e-commerce, and online marketplaces to ensure that users are genuine and legally verified.

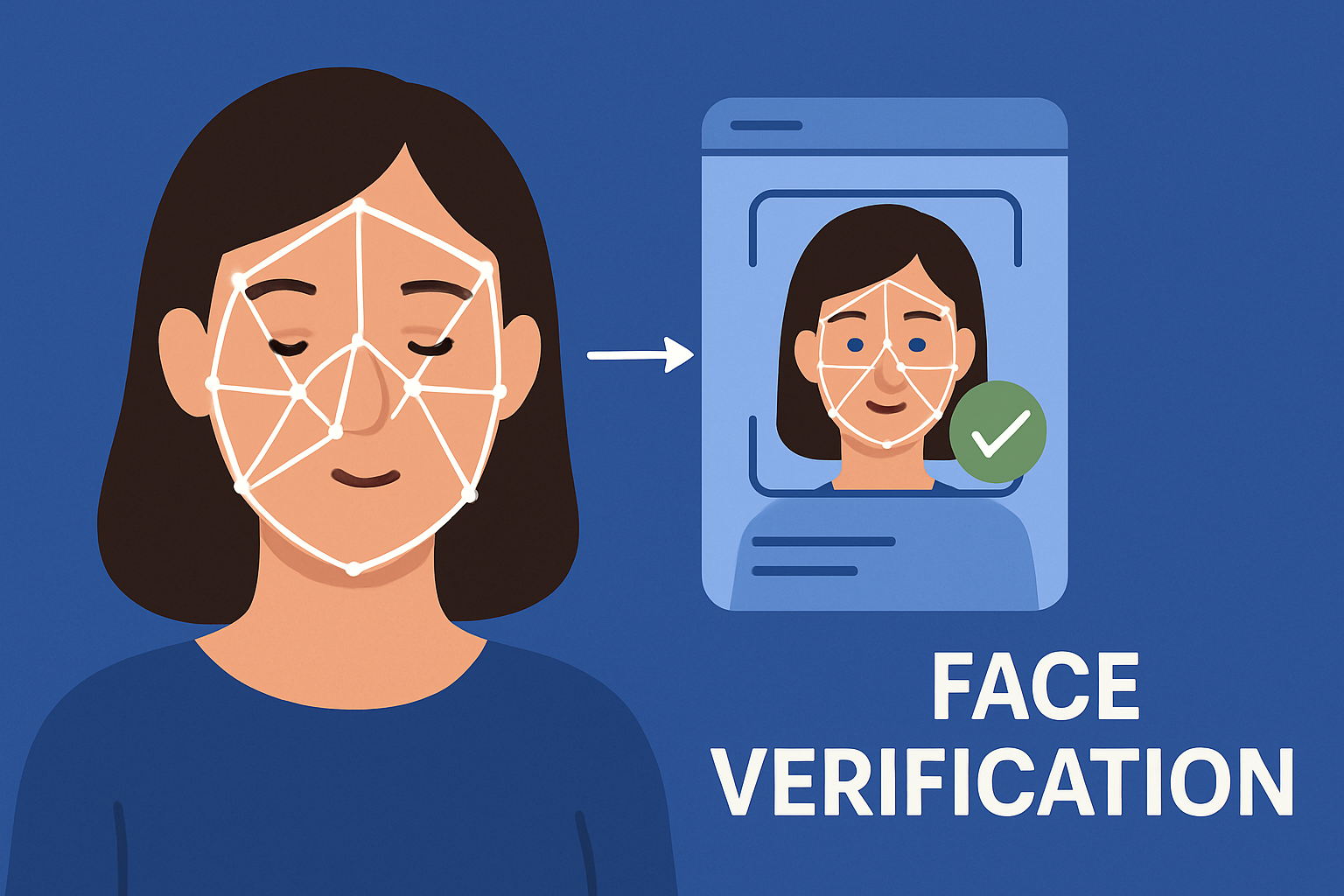

One of the most critical components of online identity verification is face match verification. This technology compares a live selfie or video of the user with the photograph present on an official identity document such as a passport, Aadhaar card, or driver’s license. Advanced AI and facial recognition algorithms analyze unique facial features, including eye spacing, nose structure, and facial contours, to confirm whether both images belong to the same person.

Face match verification plays a key role in preventing identity theft and impersonation. Fraudsters often attempt to use stolen or forged documents to create fake accounts. By accurately matching a live face with the document image, businesses can detect mismatches in real time and stop fraudulent attempts before they cause damage. When combined with liveness detection, face match verification ensures that the person is physically present during the verification process and not using photos, videos, or deepfake attacks.

From a compliance perspective, online identity verification and face match verification help organizations meet global KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations. Regulatory bodies require businesses to verify customer identities to reduce financial crimes, money laundering, and terrorist financing. Automated verification solutions provide audit-ready records, faster approvals, and reduced operational costs compared to manual checks.

Another major advantage of online identity verification is improved user experience. Customers can complete verification within seconds using their smartphones, eliminating long onboarding times and paperwork. A seamless verification journey leads to higher conversion rates, reduced drop-offs, and increased customer satisfaction.

As digital interactions continue to grow, online identity verification and face match verification will remain at the core of secure digital onboarding. By adopting these technologies, businesses can protect their platforms, ensure regulatory compliance, and deliver a safe, frictionless experience for users worldwide.

- Managerial Effectiveness!

- Future and Predictions

- Motivatinal / Inspiring

- Outro

- Entrepreneurship

- Mentoring & Guidance

- Marketing

- Networking

- HR & Recruiting

- Literature

- Shopping

- Career Management & Advancement

SkillClick

SkillClick