Inquire

Best Strategies and Locations for NDIS Housing Investment in 2025

Investing in NDIS housing has become an increasingly attractive opportunity for property investors looking to combine social impact with financial returns. The National Disability Insurance Scheme (NDIS) in Australia provides specialized housing options for people with disabilities, creating a unique and stable investment market. For investors seeking long-term growth, understanding where to invest NDIS housing, along with key market insights, is crucial to making informed decisions.

Understanding NDIS Housing

NDIS housing refers to properties specifically designed or modified to meet the needs of NDIS participants. These properties often feature accessibility adaptations such as wider doorways, ramps, and specialized bathrooms. Unlike traditional residential investments, NDIS housing caters to a growing segment of the population that requires tailored living solutions, ensuring consistent demand.

Why Invest in NDIS Housing?

-

Steady Demand: The NDIS program continues to expand, and the need for accessible housing is outpacing supply. This makes it a reliable investment for long-term occupancy.

-

Government-Backed Returns: Many NDIS housing arrangements include funding or support from government schemes, providing investors with security and predictability in rental income.

-

Social Impact: Investing in NDIS housing allows investors to make a tangible difference in the lives of people with disabilities, aligning financial goals with social responsibility.

-

Potential for Capital Growth: Locations with limited NDIS housing often see increased property value due to high demand for suitable accommodations.

Factors to Consider Before Investing

Before deciding where to invest NDIS housing, investors should evaluate the following factors:

-

Local Demand: Analyze the regional demand for NDIS housing, including population demographics and the number of NDIS participants.

-

Accessibility Features: Ensure the property can be modified or already meets NDIS standards for accessibility.

-

Proximity to Services: Properties close to healthcare, public transport, and community facilities are more attractive to NDIS participants.

-

Market Trends: Research local real estate trends to identify areas with strong growth potential and limited NDIS housing stock.

-

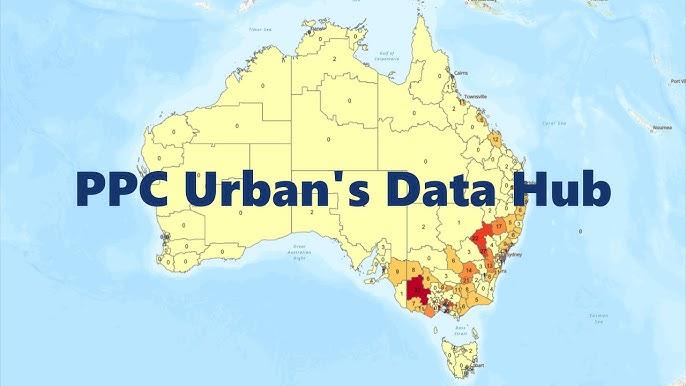

Professional Advice: Engaging experts, like PPC Urban, can help investors assess market opportunities and navigate the complexities of NDIS housing development.

Top Locations for NDIS Housing Investment

Investors should focus on areas where demand exceeds supply. Currently, some of the most promising locations include:

-

Major Cities: Sydney, Melbourne, and Brisbane continue to offer high demand for accessible housing due to larger populations and established healthcare networks.

-

Regional Growth Areas: Regional towns with expanding healthcare facilities or NDIS programs offer lower entry costs and potential for strong rental returns.

-

Areas with Limited Competition: Identifying suburbs with few existing NDIS properties allows investors to fill gaps in the market, often leading to premium rental income.

Financing and Incentives

Investing in NDIS housing may qualify for special financing options and government incentives. Banks and financial institutions increasingly recognize the stable rental returns associated with NDIS properties, making loans more accessible. Additionally, some states provide grants or tax incentives to encourage development of accessible housing, reducing initial investment risks.

Tips for Successful NDIS Housing Investment

-

Conduct Thorough Research: Evaluate demographic data, local property trends, and the specific needs of NDIS participants in your target area.

-

Plan for Modifications: Ensure the property can accommodate necessary accessibility features, either through initial construction or renovations.

-

Engage Professionals: Work with architects, builders, and property managers experienced in NDIS housing to ensure compliance and quality.

-

Diversify Locations: Consider investing in multiple regions to spread risk and capitalize on different demand patterns.

-

Monitor Policy Changes: NDIS regulations and funding models can evolve, so staying informed ensures investments remain profitable and compliant.

Challenges to Be Aware Of

While NDIS housing investment is promising, investors should be aware of potential challenges:

-

Regulatory Requirements: Compliance with NDIS standards is essential, and non-compliance can affect eligibility and returns.

-

Specialized Property Management: Managing NDIS properties often requires experienced property managers familiar with tenant needs.

-

Market Saturation in Certain Areas: Some metropolitan regions may already have high levels of NDIS housing, limiting growth potential.

Conclusion

Investing in NDIS housing presents a unique opportunity to achieve financial returns while supporting the needs of Australians with disabilities. By carefully evaluating factors such as location, demand, and property suitability, investors can make informed decisions that maximize both social impact and long-term growth. For those looking for expert guidance on navigating this specialized market, PPC Urban provides strategic insights to help identify the best opportunities. Understanding where to invest NDIS housing ensures your investment not only thrives but also contributes to a meaningful cause.

- Managerial Effectiveness!

- Future and Predictions

- Motivatinal / Inspiring

- Other

- Entrepreneurship

- Mentoring & Guidance

- Marketing

- Networking

- HR & Recruiting

- Literature

- Shopping

- Career Management & Advancement

SkillClick

SkillClick